The winner of the US presidential Election…. and Donal Trump

1. Trump Triumph

He won…I doubt I’m the one breaking this news to you, so I won’t bore you with a with generic US presidential election update. Instead, here are my high-level views on how it will impact markets.

Bull case

Pro-business, deregulation, lower taxes/further stimulus? This seemed to be the market’s reaction Wednesday. Small caps and banks were the big winners. The “best ideas” from Wall Street seemed to be Bitcoin, as the administration is expected to embrace vs fight the technology.

Bear case

Bond market continues to sell off, limiting fiscal stimulus and taking stock prices with it. This is the immediate risk in the short term as valuations become overstretched.

Slowing immigration is another drag on growth, but this will take longer to play out.

USD up in the medium term in both situations.

2. Cautious Optimism

Above-trend GDP growth, strong retail sales, strong durable goods, low jobless claims, and rising average hourly earnings, default rates continue to decline, corporate profits are at all-time highs, weekly forward profit margins are at record highs, and US household balance sheets are in excellent shape.

In short, the US economy remains incredibly strong.

But much of this is reflected in the price.

The PE ratio of the 10 largest companies in the US is almost 50

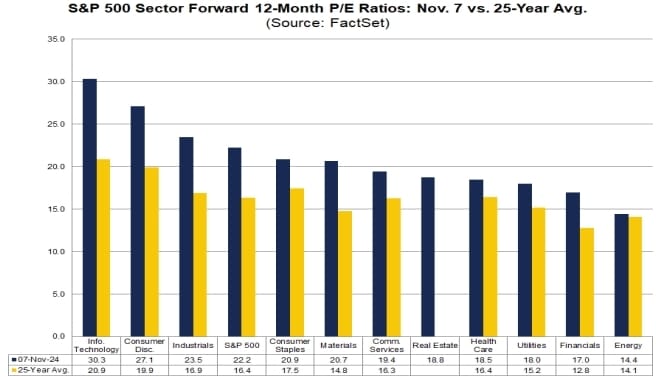

At the sector level, ten sectors had forward 12-month P/E ratios on November 7 that exceeded their 25-year averages

Stocks ain’t cheap, nor should day be. Along with the economic strength mentioned above, tailwinds such as the AI/data center boom, the Chips Act, the IRA, the Infrastructure Act, and lower taxes for domestic manufacturers and deregulation have created an environment under which these higher prices could persist.

Now as inflation expectation grows, Novembers labour numbers become crucial. In my view, we should see a dramatic increase in job growth in November, including a reversal of the weather and strike effects that were pushing down nonfarm payrolls in October. This will allow for price stability but at these levels, it’s time to take some risk off the table. The good times can persist given the economic strength but there is more downside than upside across some of the more exposed sector over the short term.

Action accordingly.

Thanks for reading

At FigTree, we help build, monitor and ensure you execute your financial plan. And as trusted advisor we will be there to help you overcome any stumbling block you encounter along the way.

I’m always happy to help wherever I can so if you want to learn more, please don’t hesitate to reach out to me at [email protected]

Mike 👋