This is Not Normal

I remember sitting in the corner of my bedroom on a fold out table and chairs in March 2020. My makeshift home office was the venue for the most insane market days of my career.

I sat, jaw on the floor, watching the moves - fully convinced I would never see anything like this again… Five years later, we’re not too far off.

The catch all statement is ‘volatility is normal’ but some weeks are a little less normal than others.

This week was one of those weeks. The list of daily moves from the Nasdaq over the last 5 trading days sums it up nicely.

Friday April 4th: -5.8%

Monday April 7th: +0.10%

Tuesday April 8th: -2.15%

Wednesday April 9th: +12.16%

Thursday April 10th: -4.31%

Two points of note here:

I wrote last week about why timing the market is so hard… Allow me to quote myself.

78% of the stock market's best days have occurred during a bear market or within the first two months of a bull market.

By jumping out to ‘protect yourself’ you are guaranteeing that you will miss almost 80% of the best days in the market.

That is why investing is so hard - so many of the best days happen around a cluster of bad days.

There is a famous BlackRock report that highlights this in a little more detail.

As you can see from the below, missing just the 10 best days over the last 20 years could cut your returns by more than half.

This week was the perfect example of that.

The moves have been violent… but the simple sum of the daily returns over the past 5 days is EXACTLY flat… 0.00%. How mad is that? (This quirk is likely far more fascinates to me than it is to anyone else, but still).

The person getting the weekly numbers presumes nothing of note has happened. Meanwhile, the person watching ever tick is having a meltdown.

If I wasn’t doing this job for a living. I know which option I would pick.

Five days, zero change.

Feels like a lifetime for those paying attention.

My Portfolio is Getting Hammered

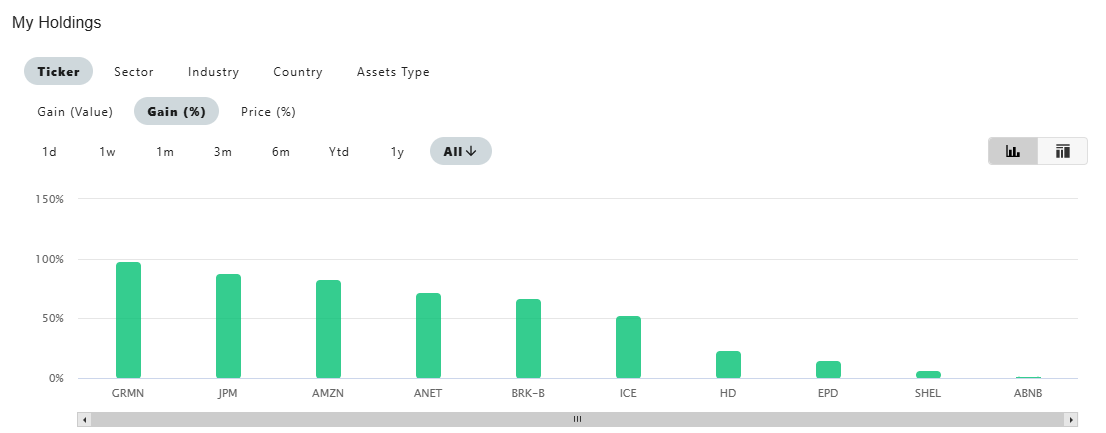

This week, I went back to see how the ‘10-stock portfolio I recommend for the long term’ was holding up.

Safe to say, it took a bit of a drubbing.

Truthfully, if this was an actual portfolio I was actively managing, I would have sold off at least three positions by now.

And that’s a crucial point I think a lot of people miss when building portfolios.

They spend hours researching what to invest in at the start, but then they stop tracking those companies over time.

Having constant conviction in any company is just laziness.

In reality you need to be constantly assessing if your original thesis is still intact, if it isn’t then you need to make changes. Fast.

In every aspect of life - the quicker you can cut out losers, the better.

When the facts change, I change my mind. What do you do, sir?

In my view, if you’re not willing to do this, then you probably shouldn’t be actively investing your own capital. But hey, that’s just me.

With all that said, the performance of this portfolio tells an interesting tale.

In just under two years. If you have put 10% of your capital in each of the 10 companies I recommended, you would have been up 86%. Not too shabby.

But wait, it’s not quite that simple.

From Feb 18th to April 8th, the portfolio experienced a 20% drawdown in just 7 weeks.

See, it all looks so easy when you zoom out. Every position is in the green, you’re up 55% in two years — what’s not to love?

But if you think the growth is linear then you are just deluded.

Over the last 3 months, some of these stocks have had their faces ripped off.

Arista Networks, for example, is down almost 37%.

The one major cognitive flaw here that tends to catch all investors, including myself, is presuming unrealised gains are actual gains. We have a tendency to lock those gains in. Making it all the more difficult when the numbers turn against us.

‘The portfolio was up 86% and now it’s up only 55%. I’m getting killed’

We become too price obsessed, but to what end. Ultimately, you can’t control price.

It’s not about checking prices every day, it’s about checking reasons.

Are the fundamentals for this company still intact?

Is the market telling you something new?

Has your original thesis for this company changed?

Taking the time to answer these instead of sitting around wondering whether the price is going to go up or down tomorrow is a much more productive use of time.

Building out conviction and analysing it over time. That’s how you turn volatility into opportunity.

So, in the midst of all the madness, make sure you are asking the right questions.

SHARE WITH A FRIEND❤️

Thanks for reading. If you enjoyed my newsletter, please share it with a friend.

If you didn't enjoy it - share it with 2 friends.

Thanks for reading

At FigTree, we help build, monitor and ensure you execute your financial plan. And as trusted advisor we will be there to help you overcome any stumbling block you encounter along the way.

I’m always happy to help wherever I can so if you want to learn more, please don’t hesitate to reach out to me at [email protected]

Mike 👋