About 10pm on a summer’s night in Killarney. Magic

It feels like everyone is asking about ‘private investments’ lately so I just wanted to get my thoughts on paper. (or whatever the internet equivalent of ‘on paper’ is)

Take this with a pinch of salt. When it comes to investing, I’m a cynic.

Unfortunately, I have seen enough to know that 90% of everything is shit.

TL:DR - Great returns exist. Most of what’s sold to you isn’t that.

Some Thoughts

When it comes to investing in private market, without question, there are standout managers and genuinely interesting opportunities but they’re the exception, not the rule.

And for those who think that private markets are the magic bullet guaranteeing diversification and higher returns I urge you to do your due diligence.

My 5 main grips:

1. Dispersion

Anyone can spin a good story about the opportunities within a specific asset class. Very few managers have the network, know-how and discipline to turn that story into consistent real returns over time.

When you are investing in things that are highly idiosyncratic with specific manager risk like venture or private growth equity, the dispersion of returns is a mile wide.

With the recent surge of new actors in the space, picking the right manager now matters more than ever, and most investors simply don’t have the access or tools to do it well.

A Flood of New Managers

The Manager You Choose is More Important Than Ever

Remember - Track record matters. And always be wary of any opportunity that sound too good to be true - it probably is.

2. Illiquidity

People talk about the “illiquidity premium” in private markets like it’s guaranteed. It’s not.

It only exists if you’re in the small subset of funds that truly outperform and those are very hard to access.

In order to generate the premium, you need manager skill, good deal flow, and a realistic exit environment. None of which are guaranteed.

Yes, I take the point that the growing emergence of secondaries, etc., offer up some liquidity here for those looking for exits but I'm not convinced that this is quite as liquidity inducing as it seems.

GP-led secondaries and continuation funds allow GPs to show activity and partial DPI, even though no real exits occurred. It’s the private market equivalent of musical chairs.

It’s all the same underlying assets

Everyone quotes IRR but DPI (distribution of paid in capital) is what really matters. If returns can’t be ‘realised’ in the timeline you expected, that can become a serious problem, regardless of what the investment is worth ‘on paper’.

Since the run up in 2021 we have seen fundraising fall off a cliff and DPI has followed.

You never lose money if you never sell… right?

Questions? I can help.

3. Lagged Pricing

There is this idea that private equity returns offer supreme ‘diversification’. They don’t.

The hint is in the name…. It’s still EQUITY!!

That doesn’t make PE better or worse, I’m just saying the ‘diversification’ side of the conversation is overstated.

The lack of correlation you see between private and public equities is a function of stale pricing not of true diversification.

Public equities are marked-to-market constantly, giving a live reflection of the actual available price. Private markets are held at cost or at the latest funding round price and are typically held there by fund managers until such time as a better price comes along.

Yes, flows can disappear, funding rounds can fall off a cliff, DPI can evaporate but don’t worry, price is still the same. Nothing to see here.

What you end up with is a portfolio that looks calm on paper but is actually just slow to reflect reality.

That supposed “low volatility” is smoke and mirrors, it’s just lagged pricing.

Something about the elegance of swan while it frantically kicks its legs under the water. You get the idea.

4. Leverage

Leverage works until it doesn’t.

Don’t be impressed by managers who’ve “used leverage well” in a one-directional market.

That’s not skill.

Anyone can strap on some leverage and ride the uptrend. You need to look for managers who’ve used leverage well across multiple market cycles and avoid those who haven’t been around long enough to be truly tested.

Again, track record matters!

‘Only when the tide goes out’... You know the rest.

5. Future Returns

One thing people keep forgetting is that the price you pay determines your future return.

Private markets aren’t immune to basic math.

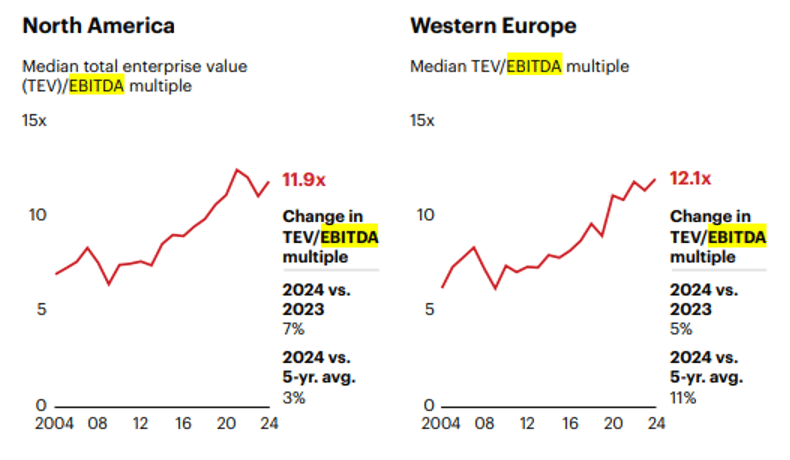

Over the past decade, entry multiples have ballooned. According to Bain’s 2025 Private Equity Report, the average buyout multiple sits around 12× EBITDA, up from roughly 8× a decade ago.

Deal Multiples near record levels

That means managers are paying roughly 50% more for the same dollar of earnings.

When your starting valuation run higher, your expected future returns fall. It's not pessimism, it’s math.

The price you pay matters!

To be fair, this isn’t strictly a private markets problem. Public market multiples have expanded over the same period. I guess that’s what happens when you pump $16 Trillion into the system in the space of 5 years.

Flows have to go somewhere.

With that said. expecting the same level of returns we saw in the last cycle while paying a much higher entry multiple is naive. The easy money era of 2010-2021 was built on falling rates and expanding multiples. Those tailwinds are gone. Going forward, returns will have to come from real operational improvement, not just financial engineering or rising valuations.

I’m not saying private market positions have no place in a portfolio. There are plenty of circumstances where they make sense.

Mid-market carve-outs where a manager can actually add operational value

Specialist funds with deep expertise

Direct lending to solid businesses with real cash flow

Secondaries where you can buy at a discount with clear visibility on exits

But those are targeted, specific, and require genuine manager skill.

Just like across all markets, it’s about efficient capital allocation. Some managers do that well. Plenty don’t. And the ‘excess returns’ you are being promised are far from guaranteed.

If we take private credit for example. An asset class that has consistently offered a genuine illiquidity premium. It still works, but it is potentially not as potent as it once was now that companies searching for lending have terms sheets on their desks from 5 different lenders.

When banks stepped back, spreads were wide and deals were attractive. Now, everyone’s piled in, competition is fierce, and spreads have tightened. The market opportunity has grown so you can still make decent returns with the right managers and the right niche but manage expectations. It’s not 2022.

Regional banks discovering why private credit pays double-digit yield

FINAL WORD

I appreciate the tone of this may suggest that I hate all things private. That’s not the case.

Private has its place and is an integral part of the overall financial infrastructure.

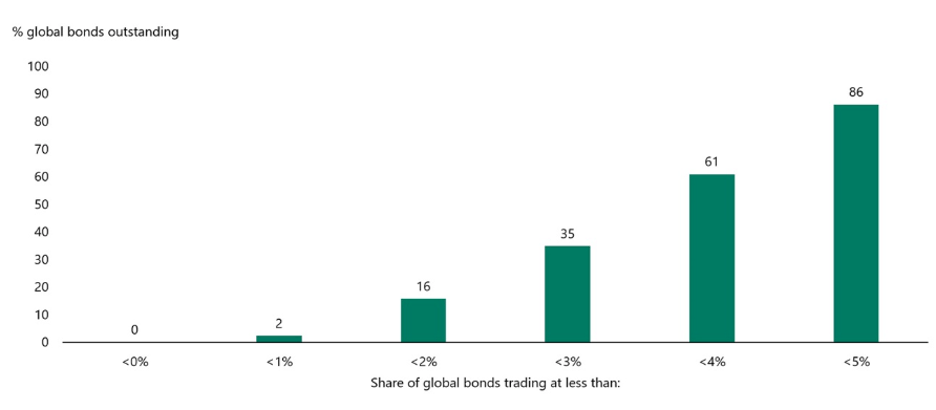

Right now, almost 90% of all public fixed income outstanding in the world trades at a yield below 5%. So, it’s hardly surprising that investors are searching for yield elsewhere.

As a result, the Private Credit market has seen an incredible rate of inflows, growing from a $100 Billion dollar market cap in 2010 to a $2.2 Trillion market today (and growing)

86% of global bonds trade at less than a 5% yield

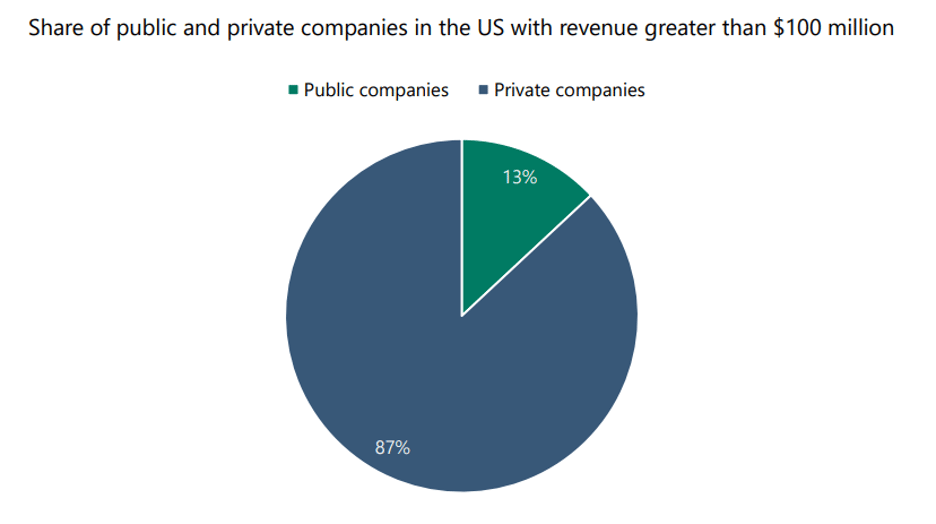

From an equity standpoint, almost 90% of US companies generating over $100M in revenue are private, so of course the market cannot be ignored.

But with 19,000 PE funds in the US alone. (for context There are 14,000 McDonald’s) you need to do your homework.

All I’m saying is not everyone offering you private market ‘access’ is worth listening to and if they are spouting something about ‘democratizing finance’ stop and ask yourself one simple question…

How many people had to reject this deal for it to fall on my desk?

Take it from someone who has learned the hard way - not all that glitters is gold.

No Sales Pitch. No Pressure.

Just a conversation to see if I can help with the problems, you need solving

Thanks for reading

At FigTree, we help build, monitor and ensure you execute your financial plan. And as trusted advisor we will be there to help you overcome any stumbling block you encounter along the way.

I’m always happy to help wherever I can so if you want to learn more, please don’t hesitate to reach out to me at [email protected]

Mike 👋