"I just don’t get it — It feels like it’s all just speculation and hype. How can you have so much confidence in something that seems so chaotic"

A direct quote from a client this week.

A fair question, given everything that has been happening recently.

When you watch the price action constantly, it’s easy to get disenchanted.

When you have layers of derivatives and leverage in a system where multiple players are playing different games, the short-term price is going to be erratic at best.

But always remember: over the long run, price follows profit.

While this may seem basic, it’s worth remembering.

The stock market doesn’t go up for no reason. The stock market has historically gone up because the profits made by the companies that make up the stock market have increased.

One of my favourite investing quotes of all time sums it up quite nicely.

Basic corporate profits have grown about 8% a year historically. So, corporate profits double about every nine years. The stock market ought to double about every nine years. So, I think — the market is about 3,800 today, or 3,700 — I'm pretty convinced the next 3,800 points will be up; it won't be down. The next 500 points, the next 600 points — I don't know which way they'll go. So, the market ought to double in the next eight or nine years. They'll double again in eight or nine years after that. Because profits go up 8% a year, and stocks will follow. That's all there is to it.

He said this in 1994 in reference to the Dow Jones Industrial Average which was 3,797 at the time.

31 years later it is 41,317. This represents an annual growth rate of exactly 8.00%.

HOW INSANE IS THAT!!

And people say the stock market is unpredictable….

You will never be able to predict the exact path forward for stocks - prices will fluctuate in the short term - but markets will trend higher over time in line with earnings growth.

Again, price goes where profits go.

If you believe that companies will continue to innovate and find new ways to generate profits over time, you need to allocate a portion of your future earnings to these companies.

It really is that simple.

There is no Such Thing as Average

Despite over a decade of studying the market, the irrational short-term moves are almost impossible to predict. There is an endless list of unknown unknowns to consider.

Claiming you know exactly what's around the corner is a display of naivety, not intellect.

But the thing is, you don't need to know exactly what's next.

It's Not as 'Risky' as You Think.

On a daily basis, stocks are up 51% of the time – little better than a coin toss.

Not exactly the guaranteed odds you're looking for when investing your life savings.

This short-term uncertainty has often acted as a deterrent for investors. But let's zoom out a bit and look at the bigger picture.

History shows that the longer your holding period, the greater the probability of positive returns.

Instinctively, everyone knows this, but let’s break down the numbers.

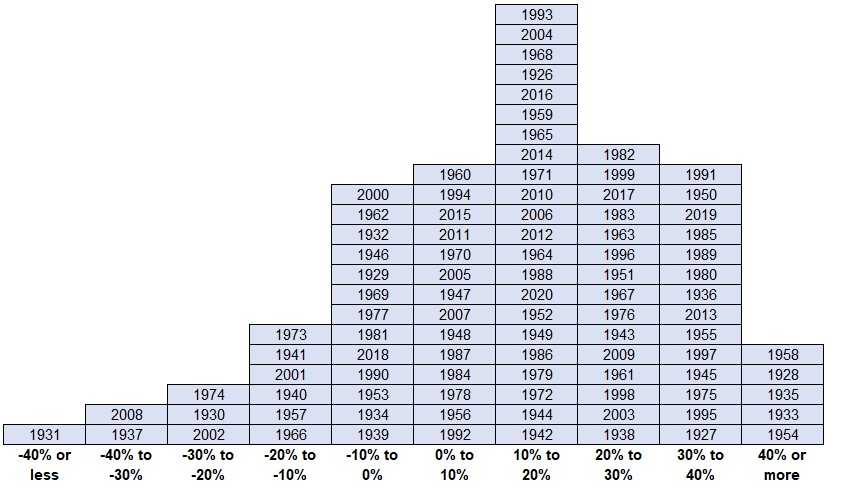

Over the past 94 years, the S&P 500 has delivered positive annual returns in 70 of them — that’s 74% of the time. The average annual return has been roughly 10%.

But here's the catch: actual returns in any given year are rarely "average."

Only 18% of the time has the S&P 500 returned between 5% and 15% in a year.

Compare that with:

25 out of 95 years with negative returns (26%)

34 out of 95 years with +20% or more (36%)

So, you’ve actually been more likely to see a +20% year than a negative one.

S&P 500 Annual Returns (1926-2020)

All of this to say: ACTUAL market returns are all over the map.

The market doesn’t do ‘average’. So set your expectations accordingly.

Thanks for reading

At FigTree, we help build, monitor and ensure you execute your financial plan. And as trusted advisor we will be there to help you overcome any stumbling block you encounter along the way.

I’m always happy to help wherever I can so if you want to learn more, please don’t hesitate to reach out to me at [email protected]

Mike 👋