Another entirely irrelevant candid picture

Yesterday it was Christmas and now… somehow… we are a quarter of the way through 2025. Not sure how that happened.

In my defense, drowning under a tsunami of daily headlines probably hasn’t helped my timekeeping skills.

I won’t regurgitate the obvious here, you’ve all seen the news. Uncertainty is widespread.

In investing, clarity is everything; it is the unknown that shakes confidence, not the facts themselves. That’s what makes investing so hard.

It’s never what has happened but what COULD happen. Recency bias has a lot to answer for here. We extrapolate current events and convince ourselves that what is happening now will happen forever. It works in both directions. We’re pros at believing the good times will never end—until they do. Then we immediately convince ourselves that the good times will never return.

That’s where we are right now as people ‘doomscroll’ the headlines.

As a result, I’ve been thinking a lot about how to help people make the right decisions in times like these.

But in a world of endless options and unknowable outcomes how do you introduce clarity and defuse the emotional rollercoaster that comes with investing?

You simplify.

You focus on what NOT to do.

It’s a far shorter list. And I would argue, it accounts for about 90% of the upside.

What’s Going on in the Stock Market

First - Some context.

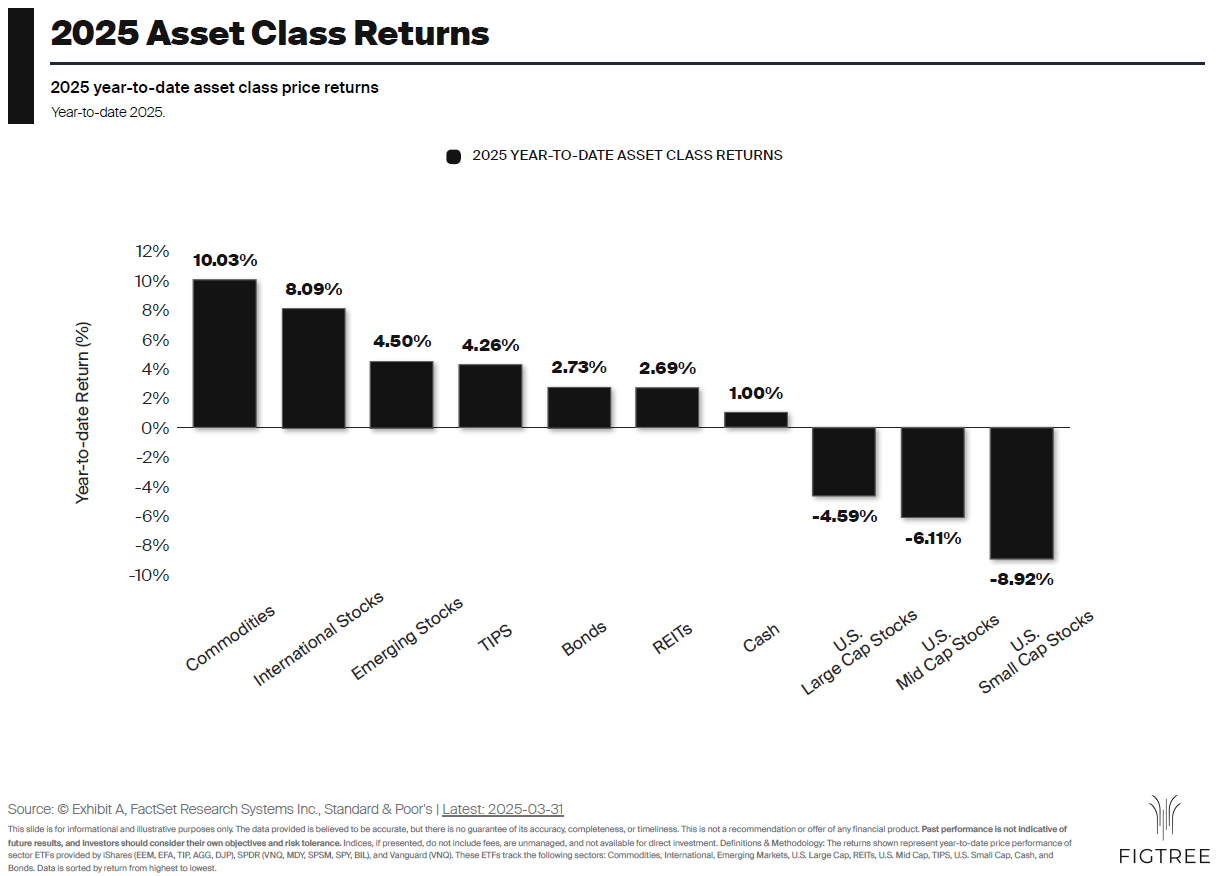

YTD returns in the US stock market have been negative. But some are getting hit worse than others.

Apple is the only company in the Mag 7 not in a 20% drawdown, with Tesla topping the charts at a -32% YTD return. The remaining S&P 493 is up 0.5%.

While the S&P500 is down almost 5% YTD, for many investors, it feels a lot worse.

Some sectors have been taken out back and shot, while other have held up. Again, if you remove just 7 stocks, the S&P 500 is positive for the year.

In the worst quarter for the S&P 500 in years, the majority of the sectors were positive.

This isn’t an ‘everything sell-off’- far from it. It just feels that way because everyone was overexposed to the names that are getting hit the most.

When the numbers just go up and to the right for two years, it’s hard to appreciate the risk you are taking in your portfolio until it’s too late.

But if you are only looking at the Nasdaq and the S&P, then you are missing the bigger picture.

Commodities are breaking out

Internation stocks are crushing it

Bonds have provided solid returns and downside protection

Turns out diversification matters.

If you find yourself looking at a bunch of stocks flashing red on your brokerage account, then you're doing it wrong.

If you're ready to simplify your financial life and invest with clarity, I’m here to help—just reach out - [email protected]

Yes, the uncertainty in the stock market is less than enjoyable - but now for the reality check.

This is normal - and can get worse. The average intra-year drawdown is 14%.

If you want the excess returns that equities have historically provided, the volatility is just the admission fee.

If you don’t want to pay that admission fee, then you need to structure your portfolio accordingly.

Since 1950, there has been over 70 instances of 5% pullbacks. It’s essentially an annual occurrence.

From a daily perspective, large daily drawdowns (1% or more) are common with an average of 31 large down days a year.

On average, that’s a month of torture that needs to be experience each and every year.

Watching the recent ‘down days’ play out has been difficult but don’t convince yourself that this is unique.

Thankfully, over the long-term, things are a little more attractive.

All this to say - what is happening now is not as life-threatening as the all-consuming headlines have led you to believe. Especially for those in a well-diversified portfolio.

There is always a justifiable reason to sell. And yet, over time, innovation continues, and corporate earnings keep growing.

In life and investing, there's always something to worry about—but almost always, you'll wish you'd worried less and lived (and invested) more.

Ok. Now that I have set the stage to within an inch of its life.

My Number 1 Rule: Don’t jump in and out.

Theoretically it sounds great: Get out when things seem risky and get back in when they don’t. Simples.

But when do you get back in, and how do you execute this strategy flawlessly time and time again?

78% of the stock market's best days have occurred during a bear market or within the first two months of a bull market.

By jumping out to ‘protect yourself’ you are guaranteeing that you will miss almost 80% of the best days in the market.

That is why investing is so hard - so many of the best days happen around a cluster of bad days.

So, if you can’t perfectly time it, what can you do?

There is a happy medium where you accept you cannot perfectly time the market, but you manage risk exposure over time. I define it as being ‘risk-on’ in a statistically defined uptrend and being ‘risk-off’ or neutral in a statistically defined downtrend.

Currently we are in the latter - all technical will show that - Which is why I have been more risk-off across portfolios this year.

But reducing risk does not mean you eliminate risk. I think of it as a gas pedal. You press a little harder when we are in a statistically defined uptrend, and you take your foot off the gas when the data shows you the opposite.

In short -don’t slam on the brakes, just reduce speed as dangerous bends approach.

As you can see from the below, while jumping out may provide some momentary relief - it is most certainly not the answer.

I actually had 9 more charts to go through here, but they will have to wait for another day.

My wife is calling me, as I am currently late for a salsa class I promised I’d attend -and not getting a divorce takes priority over newsletter writing.

Til next time. 👋

SHARE WITH A FRIEND❤️

Thanks for reading.

If you enjoyed my newsletter, please share it with a friend. It really helps.

If you didn't enjoy it - share it with 2 friends.

Thanks for reading

At FigTree, we help build, monitor and ensure you execute your financial plan. And as independent trusted advisor we work only for you.

I’m always happy to help wherever I can so if you want to learn more, please don’t hesitate to reach out to me at [email protected]

Mike 👋